Tracking this ratio can help you determine if you need to improve your credit policies or collection processes. Your accounts receivable turnover ratio measures your company’s ability to issue a credit to customers and collect funds on time. Why is it important to track accounts receivable turnover? Efficiency ratios can help business owners reduce the amount of time it takes their business to generate revenue. Other examples of efficiency ratios include the inventory turnover ratio and asset turnover ratio. Efficiency ratios measure a business’s ability to manage assets and liabilities in the short term. The accounts receivable turnover ratio is a type of efficiency ratio. On the flip side, a lower turnover ratio may indicate an opportunity to collect outstanding receivables to improve your cash flow. An average accounts receivable turnover ratio of 12 means that your company collects its receivables 12 times per year or every 30 days.Ī higher accounts receivable turnover ratio indicates that your company collects funds from customers more often throughout the year. Your efficiency ratio is the average number of times that your company collects accounts receivable throughout the year. The accounts receivable turnover ratio, or debtor’s turnover ratio, measures how efficiently a company collects revenue. What is the accounts receivable turnover ratio? Tracking this ratio is a bookkeeping staple. Knowing where your business falls on this financial ratio allows you to spot and predict cash flow trends before it’s too late.

RECEIVABLES TURNOVER RATIO HOW TO

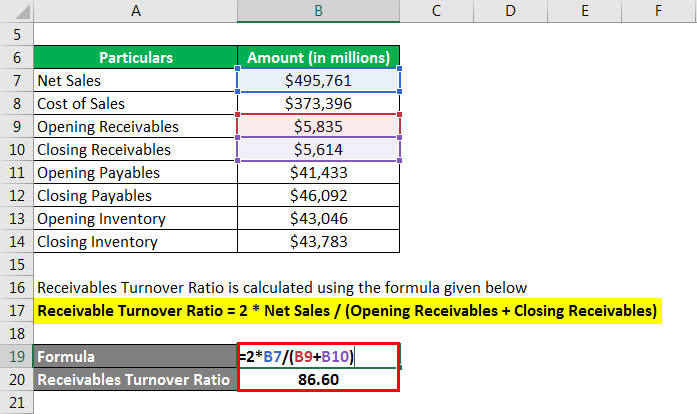

Knowing how to calculate the accounts receivable turnover ratio formula can help you avoid negative cash flow surprises.

But nearly half of them claim those cash flow challenges came as a surprise.

And more than half of them cite outstanding receivable balances as their biggest cash flow pain point. 80% of small business owners feel stressed about cash flow, according to the 2019 QuickBooks Cash Flow Survey.

0 kommentar(er)

0 kommentar(er)